In business operations, understanding the cost structure is crucial for making effective economic decisions and achieving financial stability. Costs are divided into fixed costs and variable costs, and they directly impact the profit and financial health of a business. This article will delve into the concepts of fixed costs and variable costs, discussing their practical applications in operations, and how optimizing financial performance can be achieved through calculating total costs, and contribution margin, ultimately reaching the break-even point. Through this study, readers will gain a more comprehensive and profound understanding of important concepts in business analytics, providing substantial guidance for future business management and financial decision-making.

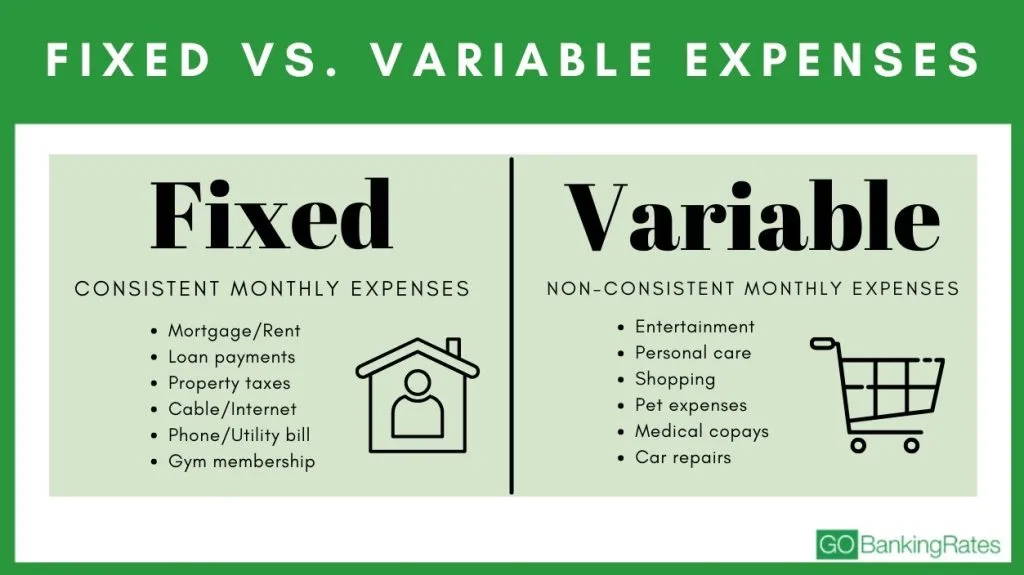

Fixed Costs: Fixed costs are expenses that do not fluctuate with production levels in the short term. Common fixed costs include rent, employee salaries, depreciation of fixed equipment, insurance expenses, vehicle leasing fees, property taxes, software licensing fees, and more. Fixed costs provide financial stability for businesses during fluctuations in production levels.

Real-life Example: Taking Coca-Cola as an example, monthly expenses such as rent, employee salaries, maintenance costs for factories and equipment, and office rent are considered fixed costs. These expenses remain constant in the short term, even if production levels change.

Variable Costs: Variable costs are directly related to the scale of production and sales, increasing with the quantity of products produced and varying with changes in production quantities. Some typical variable costs include raw material costs, direct labor, sales commissions, packaging materials, transportation costs, processing fees, electricity costs, etc. Variable costs are flexible and adjusted according to business needs and market changes, directly impacting production costs and profitability.

Real-life Example: For Coca-Cola, variable costs mainly include raw materials, labor costs for manufacturing and distribution, transportation, and logistics expenses, as well as tax costs.

Importance of Total Costs: Total costs are a crucial indicator for economic decision-making and profit-loss analysis. By considering both fixed and variable costs comprehensively, businesses can gain a comprehensive understanding of the overall cost structure of production and operations. This aids in formulating effective pricing strategies, optimizing production scales, and making informed financial decisions in business development.

Total Costs Calculation Formula: Total Costs = Fixed Costs + Variable Costs

Revenue: Revenue is the total income a company generates from selling products or providing services. For Coca-Cola, the revenue as of September 30, 2023, was $45.030 billion, according to the company’s financial report covering the fiscal year from October 1, 2022, to September 30, 2023.

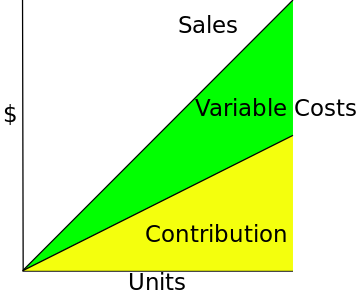

Unit Contribution: Unit contribution refers to the amount from each sales unit’s income used to cover fixed costs and contribute to profitability. It is calculated using the formula:

Unit Contribution = Selling Price per unit – Variable Cost per unit.

Contribution Margin Percentage: Contribution margin is the ratio of unit contribution to the selling price, usually expressed as a percentage. It is an important financial metric helping businesses understand the proportion of funds available in each sale to cover fixed costs and achieve profitability. The formula is:

Contribution Margin % = Unit Contribution / Selling Price per unit.

High unit contribution and contribution margin are typically goals pursued by businesses as they can enhance profitability and increase financial stability.

Profit: profit is the final surplus a business retains after deducting all expenses, including fixed and variable costs. For Coca-Cola, it can be obtained by subtracting total costs from revenue.

Profit Calculation Formula: Profit = Revenue − Total Costs

Example: According to Coca-Cola’s financial report for the 12 months ending September 30, 2023, the profit was $10.772 billion.

$10.772 Billion = $45.030 Billion − Total Costs

Total Costs = $45.030 Billion − $10.772 Billion

Total Costs = $34.258 Billion

Through this formula, we can calculate the total costs, reflecting the sum of all expenses incurred by the company during a specific period.

Break-even Point: The break-even point is the sales volume at which a business covers all costs, resulting in zero net profit. It is the critical point where the business neither makes a profit nor incurs a loss.

- Unit Break-even Point: The unit break-even point represents the number of products or services that need to be sold to cover all costs.

Unit Breakeven = Fixed Costs / Unit Contribution

Unit Breakeven = Fixed Costs / (Selling Price – Variable Cost)

- Revenue Break-even Point: The revenue break-even point indicates the total sales needed to cover all costs.

Revenue Breakeven = Fixed Costs / Contribution Margin %

Revenue Breakeven = Fixed Costs / (Unit Contribution / Selling Price)

Key Concepts:

- When sales reach the break-even point, total revenue equals total costs, resulting in zero net profit.

- Contribution profit is the amount from each sale used to cover fixed costs and contribute to profitability.

- The break-even point is a crucial reference point for businesses in pricing strategies, production planning, and financial forecasting.

By calculating the break-even point, businesses can better understand the sales volume at which they can avoid losses, enabling the formulation of more competitive strategies and decisions.